arkansas inheritance tax laws

States With Inheritance Tax. What Arkansas Residents Need to Know About Inheritance Law Here is an overview of how this site works and what articles youll find most useful.

Inheritance Scams How To Identify And Avoid A Scam

Arkansas does not collect inheritance tax.

. Arkansas Probate and Estate Tax Laws. Even though Arkansas does not collect an inheritance tax however you could end up paying inheritance tax to another state. Arkansas does not have an inheritance tax.

Arkansas also does not assess an inheritance tax which is the second type of tax seen at the state level. However the current federal tax code does not permit a credit for paid state estate or inheritance taxes. Of those seven states Maryland and New Jersey are the only ones that have both types of state level taxes.

Life insurance policies paid to named beneficiaries. This does not mean however that Arkansas residents will never have to pay an inheritance tax. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan.

The following table outlines probate and estate tax laws in Arkansas. When you go through probate administration its important to keep in mind the specific state laws for taxes and seek legal advice. Therefore Arkansas has no credit estate tax in.

Unlike most states in which the surviving spouse is the first to inherit Arkansas statute 28-9-214 states that the decedents children if living are entitled in inherit equal shares of the entire estate. However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without a valid will. Estates worth less than 25000.

This includes Sales Use Aviation Sales and Use Mixed Drink Liquor Excise Tourism Short Term Rental Vehicle Short Term Rental Residential Moving Beer Excise and City and County Local Option Sales and Use Taxes. The second round of reductions went into effect on January 1 2022 yielding a 40 percent reduction in pre-reform rates. Arkansas does not impose an inheritance tax.

In this article we go over laws specific to Arkansas as well as ways that you can receive your inheritance cash now. Arkansas imposes an estate tax equal to the maximum credit allowed under the federal tax code for paid state estate and inheritance taxes under IRC Sec. If you were married for less than three years your spouse inherits 50 of your intestate property.

Parents are not entitled to a share of their childrens personal property however if their child leaves a surviving spouse and was married. Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. The process however can take longer for contested estates.

Arkansas does not have a state inheritance or estate tax. And 2 one-third of the personal property owned by the decedent at. These rules can quickly become complicated.

Administers the interpretation collection and enforcement of the Arkansas Sales and Use tax laws. When a person does not leave a will naming beneficiaries to inherit his estate Arkansas intestacy laws set forth the order in which his heirs have a right to inherit. There are 38 states in the country that do not have an estate.

Estate And Inheritance Tax Laws. Arkansas does not have a state inheritance or estate taxHowever like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without a. Following is a simple example of how they might work.

Below is a brief overview of the dower and curtesy rules under Arkansas law. States such as Iowa New Jersey Kentucky and Pennsylvania collect inheritance tax. Home Excise Tax Sales and Use Tax.

For example if a decedent was married less than three years and has no children his parents receive one-half of his personal property assets. However residents of Arkansas will have to pay inheritance tax if they inherit property from states that collect the tax. 1 a life estate in one-third of most real estate interests that the decedent owned at any time during the marriage.

This means that a beneficiary inheriting property in Arkansas will not owe any inheritance tax. While the goodhearted latter-day Puritans and part-time clerics worried about the deleterious effects which a local option mixed-drink bill might sow among an otherwise spiritually inclined citizenry. The Inheritance Laws of the State of Arkansas which was signed by the Governor and became Act 303 of 1969.

The rest goes to other surviving relatives in the order established by Arkansas law. In Arkansas small estates are valued at 100000 or less and bypass probate proceedings entirely. The revisions to the inheritance tax law were enacted June 16 2021 with the first rate reduction made retroactive to New Years Day 2021.

Sales and Use Tax. The laws regarding inheritance tax do not depend on where you as the heir. This article covers probate how to successfully create a valid will in Arkansas and what happens to your estate if you die without a will.

This is a quick summary of Arkansas probate and estate tax laws. The amount exempted from federal estate taxes is 1119 million for 2019 but if you do not plan properly then your family or other heirs could end up getting far less of your assets than you. Arkansas intestacy laws dictate that the parents of a decedent receive a share of their childs assets.

It can be confusing to sort out the process the taxes and the issues that arise after someones death. There are only seven states that have an inheritance tax. The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax.

Decedent survived by spouse and one or more childrenthe spouse is endowed with.

Jonesboro Arkansas Estate Tax Planning Attorneys Quraishi Law Firm Wealth Management

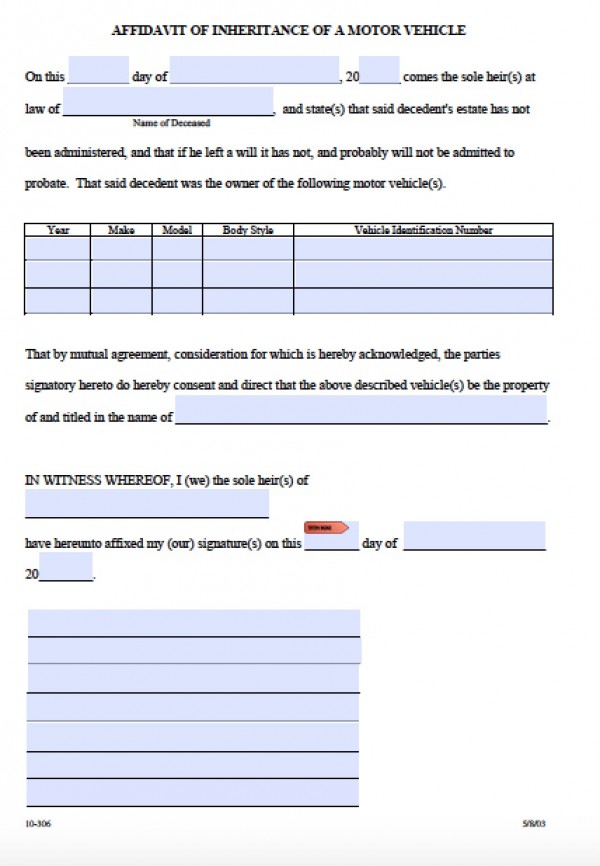

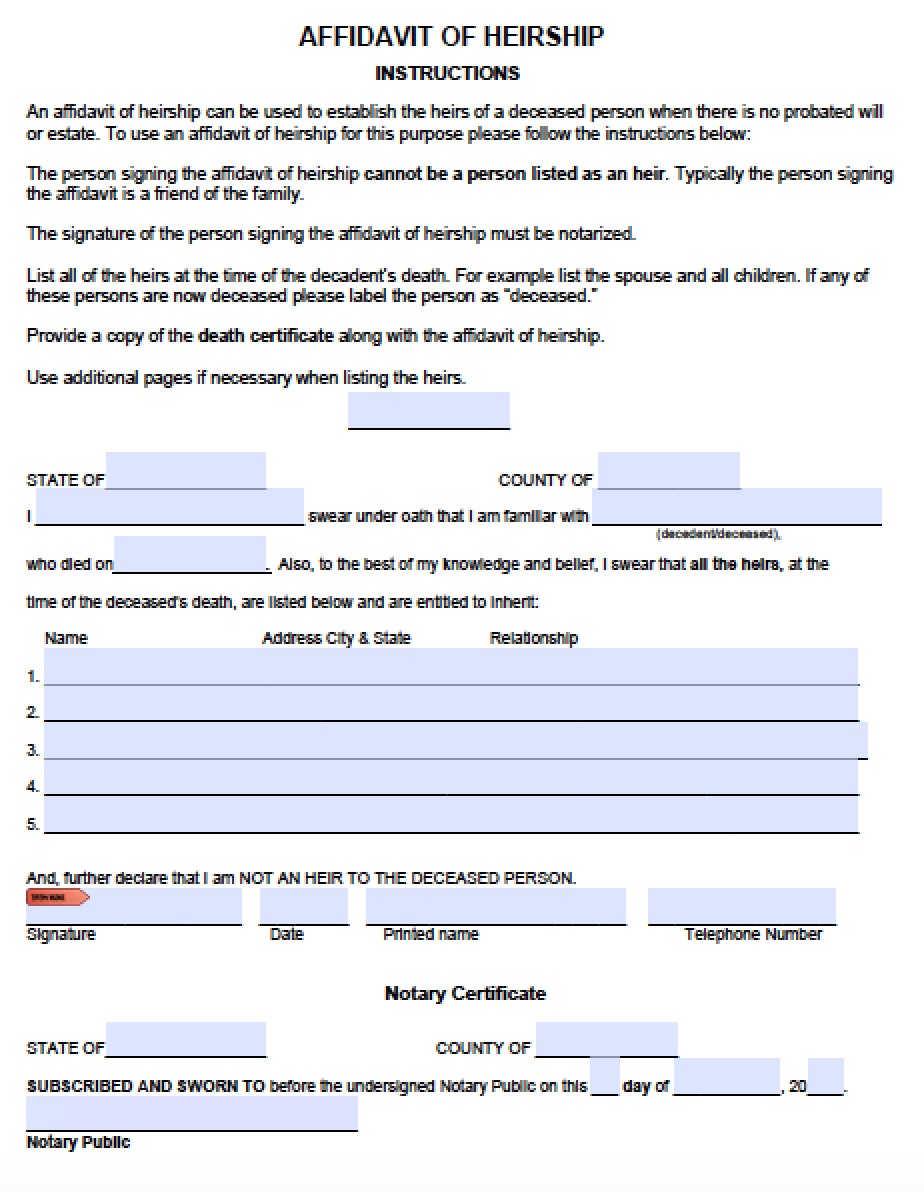

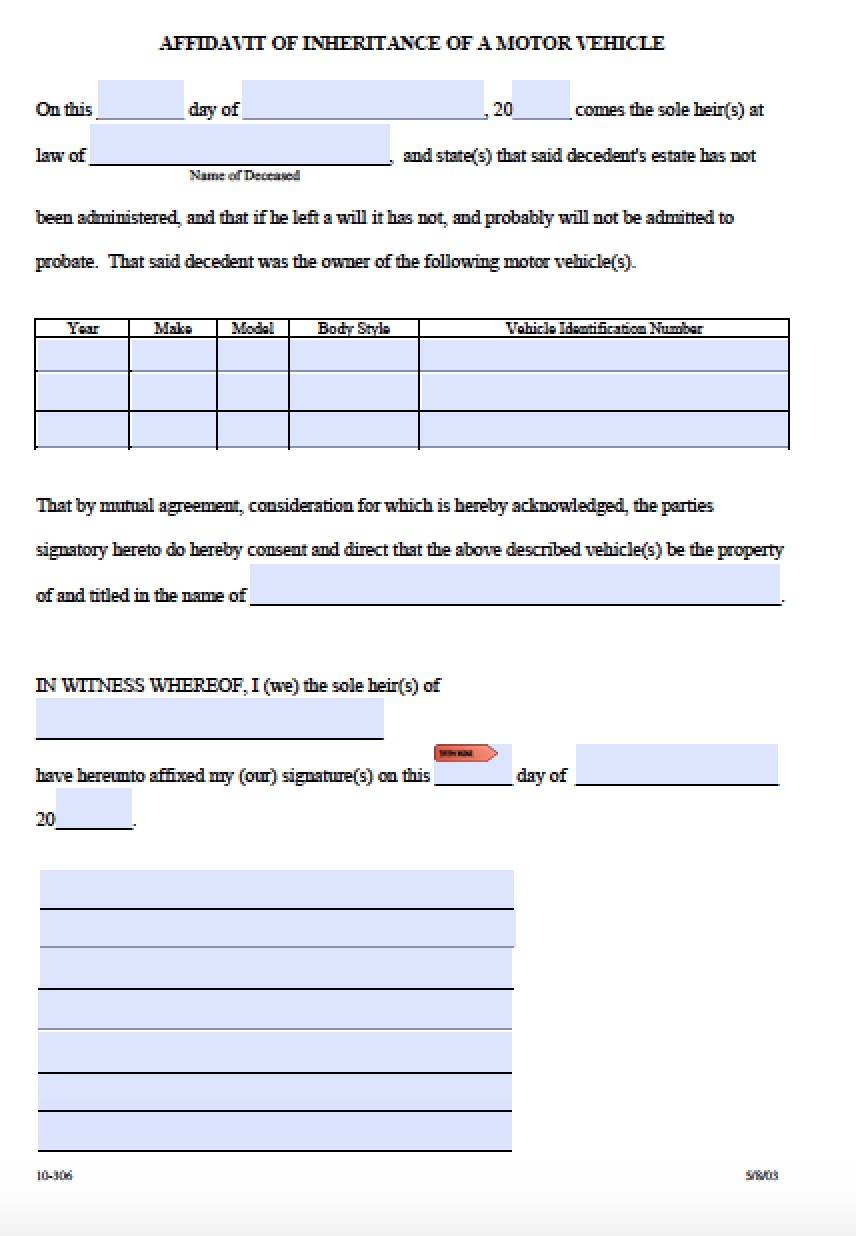

Free Arkansas Affidavit Of Inheritance Motor Vehicle Form Pdf Word

States With Highest And Lowest Sales Tax Rates

Estate Planning Faq S Sexton Bailey Attorneys Pa

How Is Arkansas Probate Law Different

Estate Planning Faq S Sexton Bailey Attorneys Pa

![]()

Jonesboro Arkansas Estate Tax Planning Attorneys Quraishi Law Firm Wealth Management

Blog Estate Planners Of Arkansas

Free Arkansas Affidavit Of Inheritance Motor Vehicle Form Pdf Word

Is There An Inheritance Tax In Arkansas

Estate Planning Faq S Sexton Bailey Attorneys Pa

Free Arkansas Affidavit Of Inheritance Motor Vehicle Form Pdf Word